|

|

|

|

#201 |

|

Diamond Member

Join Date: Jan 2002

Location: Texas

Posts: 6,014

|

way over the top, even for fox news.

I can only imagine what the victims of katrina feel when they read their misery used in this manner. |

|

|

|

| Sponsored Links |

|

|

#202 |

|

Guru

Join Date: May 2002

Posts: 40,410

|

You think they feel like palins children?

|

|

|

|

|

|

#203 |

|

Diamond Member

Join Date: Jan 2002

Location: Texas

Posts: 6,014

|

so now you are comparing the plight of those who suffered through hurrican katrina to palin's kids hearing people make jokes about their mom?

or are you comparing the victims of hurricane katrina to palin's kid who had a teenage pregnancy and, because of her poor judgement, had her personal life openly discussed? either way you're minimizing the horrible experience of the katrina victims, just like fox news is guilty of. |

|

|

|

|

|

#204 |

|

Guru

Join Date: May 2002

Posts: 40,410

|

Just an old meanie.

|

|

|

|

|

|

#205 |

|

Diamond Member

Join Date: Jan 2002

Location: Texas

Posts: 6,014

|

you've got your reason, so what's fox news excuse?

|

|

|

|

|

|

#206 |

|

Guru

Join Date: Oct 2003

Location: Cowboys Country

Posts: 23,336

|

If Palin's children are psychologically scarred--and I would agree with you, if you are making the claim, that they probably are--then who is to blame for that?

The maternal instinct protects the children, yet in this case the mother's ambition hung them out to dry. If there is dysfunction, it certainly didn't have to be. Last edited by chumdawg; 07-08-2009 at 12:19 AM. Reason: . |

|

|

|

|

|

#207 |

|

Guru

Join Date: May 2002

Posts: 40,410

|

What bullcrap...the mom hung her children out to dry. And the raped lady asked for it too, right. good grief, what in the world did this woman do to liberals, except exist.

|

|

|

|

|

|

#208 |

|

Golden Member

Join Date: May 2002

Location: McLean, VA

Posts: 1,970

|

cue to violins for the self proclaimed pitbull in lipstick....

another senseless victim in a victimized world. so sad. |

|

|

|

|

|

#209 | |

|

Guru

Join Date: May 2002

Posts: 40,410

|

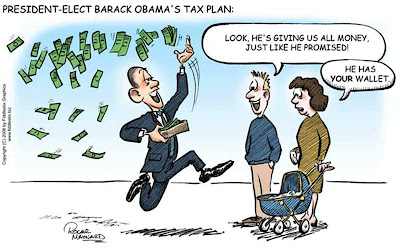

With leaders like this.....

Quote:

|

|

|

|

|

|

|

#210 |

|

Diamond Member

Join Date: Jan 2002

Location: Texas

Posts: 6,014

|

yeah, without "leaders like this" those who are unemployed would not have had their benefits extended, would be without health insurance, and there would not have been $43 billion in tax relief sent out to american families and businesses....

so what are you bitching about? do you want unemployment and health insurance benefits stopped and do you not want the tax cuts? |

|

|

|

|

|

#211 |

|

Guru

Join Date: May 2002

Posts: 40,410

|

So that was his 'emergency'? that would have been done anyway and you know it. Unemployment benefits have been extended time after time when a recession hits.

This guys "plan" is a utter and abject failure and now he wants to say it is "working". 787billion for unemployment benefits? |

|

|

|

|

|

#212 |

|

Diamond Member

Join Date: Jan 2002

Location: Texas

Posts: 6,014

|

the criticism is criticism for criticism's sake.

the benefits would not have been extended unless the support was there to extend them. all the economic data say there has been stabilization, the downward momentum has stopped. we'll see if upward trends happen. so far there can't be a label of 'failure" placed on the administration's plans/policies. again, the bitching and moaning is about something that you and every other critic supports.....are you against the extension of benefits and health insurance for unemployed? are you against the tax cuts? didn't think so... Last edited by Mavdog; 07-12-2009 at 01:30 PM. |

|

|

|

|

|

#213 |

|

Platinum Member

Join Date: Oct 2006

Location: TX

Posts: 2,505

|

What we are against is the failed policies that are causing so many to be unemployed.

Thank you President Obama, you are proving to be as big of a failure as has been predicted...meanwhile, your supporters remain blindly loyal. |

|

|

|

|

|

#214 | |

|

Golden Member

Join Date: May 2002

Location: McLean, VA

Posts: 1,970

|

Quote:

the policies of the 6 month old administration have led to swathes of unemployment? you really have NO grasp of any of the concepts of economics, do you? You do realize that unemployment is a "lagging indicator" right? and you know what that means, right? and you also know that macroeconomic movements are measured in years and often decades, or at least QUARTERS right? I am sorry but the two of you harping on the economic performance 6 months into the start of a president whose administration took over in the middle of a trough of the biggest disruption the WORLD has seen in 75 years... just makes you sound like blathering morons. you can make arguments to criticize these guys about.. there are plenty of policies to choose from... and the evidence of the effects of the policies for this administration will provide fodder for debate for AT LEAST the next decade or so... but really, the lines of argument that you two CHOOSE makes you sound like the little kids that ask "are we there yet?" before the car even leaves the driveway on the trip to disney land. ***Note**** i am sure you have already begun the "blind Obama loyalist defense..." response.... please re-read before you post it. Ok? ------- criticize and debate the policies of the Obama administration .... THAT IS FINE. expecting immediate zigging and zagging of the economy from month to month... THAT is boogar eating idiocy. It is possible that the Paulson/Geithner/Benanke/Bush/Obama stimulus and liquidity injections prevented an absolute cratering of the economy... THAT would have been abrubt macroeconomic movement (but you can't measure counterfactuals, nor the LACK of an abrupt crash)... but other than a CRASH, economic movements have a lot of inertia, and are slow to shift direction and move. Pretend like you understand this fact. |

|

|

|

|

|

|

#215 |

|

Golden Member

Join Date: May 2002

Location: McLean, VA

Posts: 1,970

|

...............

Last edited by mcsluggo; 07-14-2009 at 10:10 AM. |

|

|

|

|

|

#216 |

|

Diamond Member

Join Date: Sep 2007

Posts: 5,249

|

__________________

Is this ghost ball?? |

|

|

|

|

|

#217 |

|

Guru

Join Date: May 2002

Posts: 40,410

|

|

|

|

|

|

|

#218 |

|

Diamond Member

Join Date: Jan 2002

Location: Texas

Posts: 6,014

|

good news on the economic front...apparently the policies of the current administration are making headway in turning around the recession.

---------------------------------------------- JULY 21, 2009 Leading Indicators Signal Recovery Likely in 2nd Half By GREG ROBB | MarketWatch WASHINGTON -- The U.S. index of leading economic indicators rose 0.7% in June, the third straight monthly gain, the Conference Board said Monday, signaling that a recovery is likely in the second half of the year. Over the past six months, the index has improved at a 4.1% annual rate, up sharply from a negative 6.2% rate in the prior six months. This is the fastest pace since the first quarter of 2006. The trend is consistent with a slow recovery this autumn, according to Ken Goldstein, an economist at the Conference Board. "The unqualified jump in the index holds out hope that the upturn is not far away," said Joel Naroff, president of Naroff Economic Advisors. The gain in the index was in line with estimates of Wall Street economists, according to a survey conducted by MarketWatch. Seven of the 10 indicators increased in June. The positive contributors -- beginning with the largest positive contributor -- were interest-rate spread, building permits, stock prices, weekly initial claims, average weekly manufacturing hours, index of supplier deliveries, and manufacturers' new orders for consumer goods and materials. The negative contributors were real money supply, manufacturers' new orders for nondefense capital goods, and index of consumer expectations. The coincident index fell 0.2% in June on continued weakness in employment and production. That suggests second-quarter economic activity is likely to be negative. The lagging index fell 0.7% in the month. "All in all, the behavior of the composite indexes suggests that the recession will continue to ease and that the economy may begin to recover in the near term," the Conference Board said. "The critical question is what is next," said Josh Shapiro, chief U.S. economist at MFR Inc. "Our feeling is that the data will start to flatten out, indicating an elongated trough for the economy. We'll know in the next several months whether this is an accurate assessment of the situation." The severe U.S. recession is slowly abating, but most companies are still cutting costs, and few have immediate plans to hire more workers or increase their capital spending, according to a quarterly survey released Monday in Washington by the National Association for Business Economics. ------------------------------------------------------------------- Fed's Lending Ebbs as Crisis Subsides By SUDEEP REDDY and ANUSHA SHRIVASTAVA Demand for the Federal Reserve's emergency short-term lending programs is abating, the latest sign that credit markets are healing. Borrowing through a program the Fed launched to support the market for commercial paper, short-term corporate IOUs, is at less than one-third its peak level. Securities dealers and investment banks haven't used a Fed borrowing program, launched amid Bear Stearns woes in March 2008, for 10 weeks. Overseas central banks borrowing of dollars from the Fed is running less than a fifth of its $583 billion peak. Meanwhile, a Fed facility that allows securities firms to trade hard-to-sell collateral for Treasury debt showed just $4 billion in volume recently, down from more than $235 billion in October. And the program through which the Fed auctions to banks is down almost 45% from March. "The Fed has been able to shift the dominoes in the other direction by very aggressive liquidity policies," said Michael Darda, chief economist at MKM Partners, a trading and research firm. "Now you have these emergency liquidity programs rolling off as these markets improve." The Fed's overall balance sheet -- the total of all its loans and securities holdings -- stood at $2.06 trillion for the week ended Wednesday, below the $2.3 trillion peak reached last fall, though it grew from $1.98 trillion a week earlier. When Fed officials met in late June, Fed staff said the size of the balance sheet "might peak late this year and decline gradually thereafter," according to minutes released recently. The Fed has purchased only about half the up to $1.75 trillion in Treasury long-term debt, mortgage-backed securities and debt issued by Fannie Mae and Freddie Mac that it said it may buy. It also is expected to lend more through a joint initiative with the Treasury Department to revive the market in which consumer and business loans are turned into securities, an effort to make credit more widely available. Since the credit crisis began almost two years ago, the Fed has gone well beyond its traditional lending to commercial banks and launched a dizzying set of programs, each with its own acronym, that has it lending to such big financial firms as American International Group Inc. and even, indirectly, to industrial companies through the commercial-paper market. At its peak, the Fed was one of the biggest holders of commercial paper -- $350 billion, or 20% of the market. Commercial-paper holdings in that program are down to $111 billion and fell by $1.84 billion in the week ended Wednesday. The program gave investors comfort, when liquidity was strained last fall, that issuers could access the Fed facility as a backstop, said Chris Conetta, head of U.S. commercial-paper trading at Barclays Capital. "It allowed cooler heads to prevail and gave time for other programs to develop … where companies could get longer-term debt." The vast majority of commercial paper being purchased was issued by non-U.S. banks, and many of those issuers ultimately received guarantees from their governments, Mr. Conetta said. Now he expects the program to end in February unless the market changes substantially. Although credit-market conditions are improving, they aren't -- and may not for a long time -- returning to precrisis levels. Borrowing is expected to remain restrained in the coming years as households reduce debt and lenders display more caution in their standards, said David Resler, chief economist at Nomura Securities. "Greater discretion of who they lend to is a healthy sign," he said. "Indiscriminate borrowing and lending is what got us into this mess." The Fed is still ramping up its initiative to revive securitization of consumer and business loans, the Term Asset-Backed Securities Loan Facility. Loans in this program expanded to $30.1 billion in the week ended Wednesday from $24.9 billion a week earlier. At the height of the credit crisis, no one wanted to buy bonds backed by auto, student and credit-card loans as investors feared these bonds would perform as poorly as their cousins in the home-loan sector. Now that it is apparent these securities aren't in danger of wholesale ratings downgrades, long-term investors such as insurance companies and pension funds are returning. But the consumer-loan market isn't as healthy as it once was: Issuance is at half the level it was at this time last year. While the auto and credit-card sectors are seeing a rebound, there hasn't been a similar surge in other areas like equipment-backed deals. That means the securitization market, while on the mend, still needs Fed crutches -- and may need them well past the program's scheduled expiration at the end of this year. |

|

|

|

|

|

#219 | |

|

Guru

Join Date: May 2002

Posts: 40,410

|

Heh...

Quote:

|

|

|

|

|

|

|

#220 |

|

Diamond Member

Join Date: Sep 2007

Posts: 5,249

|

It's gonna be the world's first job-loss economic recovery.

They got one thing right: like every new advance in modern civilization, sell the idea to the porn crowd for success. Ie, $700 million for horse condoms. That's gonna require a LOT of film, gentlemen.

__________________

Is this ghost ball?? Last edited by DirkFTW; 07-20-2009 at 08:29 PM. |

|

|

|

|

|

#221 | |

|

Diamond Member

Join Date: Sep 2007

Posts: 5,249

|

Things that make you go Hmmmm....

Link Quote:

__________________

Is this ghost ball?? |

|

|

|

|

|

|

#222 |

|

Diamond Member

Join Date: Feb 2006

Location: Basketball fan nirvana

Posts: 5,625

|

there's generally a good reason to make a distinction between GAAP earnings and earnings from continuing operations (however you'd like to phrase it). GAAP earnings often include one-time extraordinary charges that aren't indicative of what a company can earn on a continuing basis.

....like the Textron thing....yeah, I can understand on one hand how Textron spent a lot of money to shut down a plant while also understanding on how they did pretty well on the stuff that they didn't shut down, so both pieces of information are relevant and plausibly realistic (plus, Textron is a war-profiteer that rakes in billions from the gubmint every year, I suspect they'll do fine for a few years to come). ...so....most of these distinctions above are analysts making adjustments for non-recurring events. The thing about non-recurring events though is they tend to happen most every year.

__________________

"It does not take a brain seargant to know the reason this team struggles." -- dmack24 |

|

|

|

|

|

#223 | |

|

Guru

Join Date: May 2002

Posts: 40,410

|

You go Barry...He is definitely making some history, problem is the records he is shattering are all in the wrong direction.

Quote:

|

|

|

|

|

|

|

#224 |

|

Diamond Member

Join Date: Sep 2007

Posts: 5,249

|

After the collapse of 2008-2009, it's really hard for me to ignore Peter Schiff. And he still paints an ugly picture.

__________________

Is this ghost ball?? |

|

|

|

|

|

#225 | |

|

Guru

Join Date: May 2002

Posts: 40,410

|

Quote:

|

|

|

|

|

|

|

#226 |

|

Diamond Member

Join Date: Feb 2006

Location: Basketball fan nirvana

Posts: 5,625

|

Even a dead count will bounce if you drop it from a sufficient height.

I think we're basically seeing the benefit of the bernanke put option on the market. Sooner or later something is going to give...either bernanke is going to print us into oblivion (less likely, imo) or he's going to throw on the breaks (more likely, imo) and interest rates will go through the roof. If the former, it doesn't really matter what you do. If the latter, stocks are the last place you'll want to be. That said, bigger fool waves can last a long time. Timely and wrong is way better than untimely and right.

__________________

"It does not take a brain seargant to know the reason this team struggles." -- dmack24 |

|

|

|

|

|

#227 | |

|

Diamond Member

Join Date: Feb 2006

Location: Basketball fan nirvana

Posts: 5,625

|

peter schiff's advice to dear leaders:

Quote:

__________________

"It does not take a brain seargant to know the reason this team struggles." -- dmack24 |

|

|

|

|

|

|

#228 | |

|

Guru

Join Date: May 2002

Posts: 40,410

|

Must be good news. Since so little of the "stimulus" has been spent and the economy seems to be recovering, barry will be able to say that his "policy" improved the economy AND bought votes at the same time. It's a win-win!!

Quote:

|

|

|

|

|

|

|

#229 |

|

Diamond Member

Join Date: Jan 2002

Location: Texas

Posts: 6,014

|

it's fascinating really to see how the critics of the current administration are reacting to the apparent success of the obama team's handling of the recession.

when the recession was threatening to turn into a real depression, the administration reacted with speed to address what they saw as the issues: lack of liquidity in the financial markets and a lack of faith by the public that there was a sense of what to do about the problems. so here we are 9 mos later...the markets seem to be relatively stable, the public isn't freaking out, there is a general sense that we have indeed avoiding a meltdown, and the critics still do not want to give any credit to what the obama team has accomplished, but rather bitch and moan. while they scream about the too high federal deficit, they also scream about not spending more of the stimulus funds. the obvious contradiction isn't seen by them, which in itself would be darn funny if it wasn't so irritating. give credit where credit is due, and the obama team has done well so far in handling the situation. that doesn't mean they get a pass for the future, let's see how they maneuver around the need for reduction in the amount of money floating in the economy, the ridiculous deficit, and the clear fact that interest rates will not stay and so low a level forever. a good job so far, plain and simple. |

|

|

|

|

|

#230 |

|

Member

Join Date: Feb 2007

Posts: 317

|

If you consider a bill that has more money slated to go into the economy years down the road stimulus, maybe. That is also ignoring TARP, which team Obama voted present on, as far as opinion.

I was against TARP, at least as it was structured. I don't think people are regarding the stimulus plan in the way you think. It's perfectly logical to question the wisdom of it in the first place, then also point at the execution, or lack their of, as another item and be consistent. It's like not liking the color of house and then pointing out the paint is flaking and blistering because the people doing the job neglected to use a primer. We are currently monetizing debt. http://economistsview.typepad.com/ec...s_debt_mo.html http://www.chrismartenson.com/blog/f...-auction/23880 If team Obama had cap and trade and the health care reform pushed through, it would be even worse. This is a long way from over, the real impact will be measured in years. Being in a situation where it is an advantage to the Fed to have high inflation, is neither pure or simple. The other shoe is at 20,000 feet and dropping. |

|

|

|

|

|

#231 |

|

Golden Member

Join Date: May 2002

Location: McLean, VA

Posts: 1,970

|

i personally find the juxtaposition of this thread, with the "Kabooom" thread hilarious.

http://www.dallas-mavs.com/vb/showth...t=19848&page=7 after many years of trying to define new ways to measure economic success in order to bold state the vigor of the Bush economy, Dude has, without losing a beat, changed the cadence to define spectacular failure in the current context. Its kinda cute, actually. |

|

|

|

|

|

#232 | |

|

Guru

Join Date: May 2002

Posts: 40,410

|

It figures. So we now know that at least Barry's stimulus has created 110,000 jobs. Pretty good eh?

Quote:

|

|

|

|

|

|

|

#233 | |

|

Diamond Member

Join Date: Jan 2002

Location: Texas

Posts: 6,014

|

Quote:

wow

|

|

|

|

|

|

|

#234 | |

|

Diamond Member

Join Date: Feb 2006

Location: Basketball fan nirvana

Posts: 5,625

|

Helicopter Ben's big accomplishment:

Quote:

way to go Ben.....

__________________

"It does not take a brain seargant to know the reason this team struggles." -- dmack24 |

|

|

|

|

|

|

#235 |

|

Guru

Join Date: May 2002

Posts: 40,410

|

|

|

|

|

|

|

#236 |

|

Member

Join Date: Feb 2007

Posts: 317

|

|

|

|

|

|

|

#237 | |

|

Guru

Join Date: May 2002

Posts: 40,410

|

You go girl..This will help I'm sure....

http://network.nationalpost.com/np/b...lose-them.aspx Quote:

__________________

"Yankees fans who say “flags fly forever’’ are right, you never lose that. It reinforces all the good things about being a fan. ... It’s black and white. You (the Mavs) won a title. That’s it and no one can say s--- about it.’’ |

|

|

|

|

|

|

#238 | |

|

Guru

Join Date: May 2002

Posts: 40,410

|

The barry hits just keep on keeping on. At this rate will he lose more jobs than any president in history? I seem to recall that little factoid being tossed around about dubya.

Quote:

__________________

"Yankees fans who say “flags fly forever’’ are right, you never lose that. It reinforces all the good things about being a fan. ... It’s black and white. You (the Mavs) won a title. That’s it and no one can say s--- about it.’’ |

|

|

|

|

|

|

#239 | |

|

Diamond Member

Join Date: Jan 2002

Location: Texas

Posts: 6,014

|

Quote:

here is an article that speaks positive about the economic trend. hopefully the predictions are right and employment will follow. Global Economy Gains Steam |

|

|

|

|

|

|

#240 |

|

Guru

Join Date: May 2002

Posts: 40,410

|

Tell it to the 240K who lost their job last month.

__________________

"Yankees fans who say “flags fly forever’’ are right, you never lose that. It reinforces all the good things about being a fan. ... It’s black and white. You (the Mavs) won a title. That’s it and no one can say s--- about it.’’ |

|

|

|

|

| Tags |

| american egonomics ftw, cool to hate obama yet?, economics for morons, got a bit fluffy in here, gtl, the dude1394 forum |

«

Previous Thread

|

Next Thread

»

|

|

All times are GMT -5. The time now is 07:26 PM.

Graphic

Graphic

Linear Mode

Linear Mode